All businesses face it, but what makes some businesses thrive and overcome and what causes others to fail in the face of difficulty? Lecturer, Ron Finklestein, outlines ways that businesses can overcome the adversity they face.

Tuesday, June 30, 2009

Monday, June 29, 2009

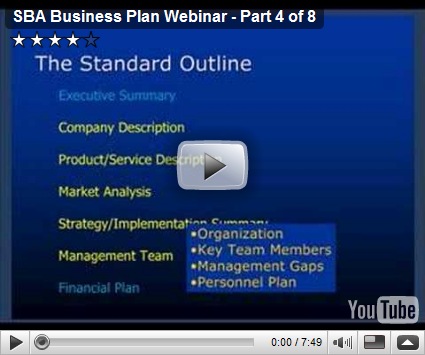

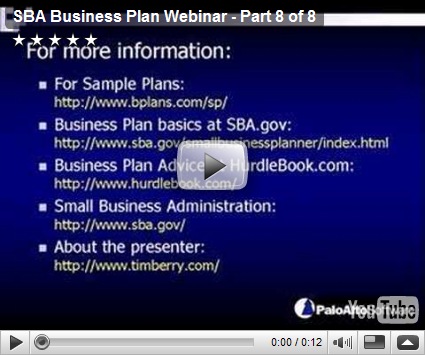

SBA Webinar on Business Plan Development

Imbedded are links to some videos of a webinar by business plan expert, Tim Berry, on how to develop your business plan. Planning and re-planning are critical to the success of any small business. Each is a good resource.

How Profitable is Your Business

Now is a great time for you as a small business to evaluate your profitability and make some goals for improvement. The UNF Small Business Blog has some great advice on what to look for to test the profitability of your business. See their suggestions here:

http://unfsbdc.blogspot.com/2009/06/small-business-summer-checkup-for.html

Tuesday, June 23, 2009

Small Business Website Content Development

It seems like the internet has become an interactive yellow pages for businesses to engage their market through various social media formats. The most traditional form of engagement is, of course, the website. But with the billions of websites out there, it is your content that will set your site apart from others. Here are some good insights into how to develop the content of your websites:

http://smallbiztrends.com/2009/06/content-ideas-for-your-site.html

Monday, June 22, 2009

Florida Growth Fund

The state of Florida is establishing a venture capital fund to assist technology companies with the development of their products. This is great news especially for businesses struggling to find financing in this economic downturn. Read more here:

Monday, June 15, 2009

What is your company’s social media plan?

The Miami Herald did an article on social media and outline some of the things that businesses face in this growing marketing trend. Like any marketing or business plan, it is important to look at a couple of elements: time, cost, and relevance. The first two are key to many small businesses. Effective social media campaigns grow over time and do have built in cost potential. Should you hire someone specifically to manage a social media campaign? How do you make that determination. How frequently will you blog? Update a Facebook company page? Send tweets? Also, how are you going to develop your online “following”? Social media is definitely a major part of today’s market and should not be ignored, but it also needs to be an effective tool in a businesses arsenal.

Thursday, June 11, 2009

Local Lessons From International Business

Expanding on some of the principles of marketing, localization and internationalization discussed already. Here are two articles that articulate what businesses need to look for as they expand into any market. Two keys: Improve your planning and research your market. Here you go…

http://ezinearticles.com/?Could-You-Extend-Your-Business-Abroad?&id=2457621

http://ezinearticles.com/?Think-Local,-Act-Global-For-Businessmen&id=2440915

Maintaining Financial Records

This is an interesting article that focuses on sustainability for small businesses in the developing world, but the principles apply to all small businesses. It is critical to modernize and improve your record-keeping in order to ensure proper documentation of finances and company development. When you write it down, you are more likely to follow through. Enjoy the article…

Wednesday, June 10, 2009

Working with Family

This article explores some of the potential pitfalls that can come when working with or hiring family in your business. Working with family can provide certain benefits to a small business, especially in a downturn, but one needs to be able to properly separate the business and the personal relationships. When a business owner is realistic about the skills of a family member and their ability to contribute to the business, it is more likely for the working relationship to succeed. Some of the principles presented in the article related to family employees can and should be applied with any employer/employee relationship.

http://www.smartmoney.com/personal-finance/employment/mixing-family-and-work/?cid=1122

Monday, June 8, 2009

Interesting Blog on Social Media in Fortune Companies

Web 2.0 and the benefits of social media in business are hot topics right now. Small business and large corporations have both benefited and suffered from the added marketing/exposure that comes from social media. Here is an interesting blog about what Fortune Companies are doing to maximize the benefits of social media.

Knowing Your Local Market

One of the key aspects of doing business is knowing your market. This process of learning your market becomes increasingly more complex as businesses expand operations internationally. As you look at opportunities to expand, it is necessary. In this Ezine article by Ian Sawyer, some general types are given for businesses engaged in a localization of markets. The focus of your business efforts should always been on learning what makes your market “tick” and how to target them specifically to maximizes the work that you can accomplish for them.

http://ezinearticles.com/?The-Importance-of-Localization-in-a-Global-Economy&id=2404776

Weathering the Storm

All businesses know that this is a difficult economic time. Businesses are struggling with funding/credit issues, clients who are late on payments and the loss of consumers. In times like these it is always helpful to learn from what other businesses are doing to weather the storm. This article in the Orlando Sentinel illustrates what the construction company, JCB Construction is doing in order to adjust to the changing economic situation. Two key takeaways or lessons from JCB: 1) See what things you can bring in-house to cut down on expenses and 2) seek, more than even, to get your name out by getting your company in articles or blogs, etc. This will increase your exposure to potential clients or customers. All the best as we work together to succeed in business.

http://www.orlandosentinel.com/business/orl-cfbcover-butler-060809060809jun08,0,3935585.story

Wednesday, June 3, 2009

Small Business Self-Readiness Assessment

The Small Business Administration has an assessment tool that potential small business owners can use to determine their own readiness. This assessment tool is a good resource but needs to be taken in context. Each individual business situation is distinct and there are always factors that these types of assessments miss. That being said, this is a good piece to the preparation puzzle. Here is the link:

http://www.sba.gov/assessmenttool/index.html

(Note: The link was found on www.hispanicsmb.com)

Resource for Florida Small Businesses

Enterprise Florida has a great list of resources for small businesses in Florida. Check it out here:

Tuesday, June 2, 2009

Working With Your Small Business Abroad

This is an interesting article that outlines some of the things you should consider as you are looking to expand your work abroad. Some key takeaways from the author’s perspective: 1) Know the culture where you will be operating, 2) Create connections in the new market and build that network, and 3) LEARN THE LANGUAGE. Many of the principles discussed can be applied do doing business locally as well. Enjoy the read!

http://ezinearticles.com/?Working-With-Your-Small-Business-Abroad&id=2331153

Access to Capital

One of the first and most consistent ongoing concerns of a small business is access to capital. Even the best of ideas can be derailed if you do not have the right amount of money to cover all the costs associated with operating that specific type of business. One of the first things that a business needs to do in planning for their startup is to evaluate what their options are for capital. There are three main options for business funding with their benefits and detriments. Each will be outlined below with a list of helpful links at the end of the document. Nothing linked in this article is endorsed by the author of this blog.

Traditional Loans/Grants

One of the first avenues that most start up companies explore is traditional lending. This is generally in the form of a business loan or line of credit established with a bank or other lending institution. For a start up, these loans are generally tied to the owner's credit and debt/income ratio. As such, the current economic situation has made it difficult for small businesses to gain access to capital.

In order to allow small businesses easier access to lending, the Small Business Administration has established several government-backed lending programs. These loans are still provided by traditional lenders, but are backed by the SBA making these lenders more likely to approve the loan. The SBA website listed below has information on all their loan packages.

Capital Investment

There are many capital investment firms or "angel" investors that are willing to front significant capital to a new venture in exchange for ownership in the enterprise. The main thing that a capital investor is looking for when they are considering where to invest is their return on investment. That means that many times a capital investor will come in seeking significant control or division of profits in a venture that they are investing in. Depending on the amount of money a venture needs, it is important to evaluate what you are willing to sacrifice in order to get the capital that you need. You would be wise to read about different venture capitalists in order to see what industries they have worked in, past success rates, and similar metrics. If you have a great idea, you may be able to get capital, but you will have to give up a lot of control or profits in the process.

Peer to Peer Lending

Companies like Prosper.com and Lendingclub.com have set up sites that allow people to lend money to other people. The benefit to using these types of lending sites is that it allows individuals to receive smaller loans from other people that would like to invest in different ways. The sites themselves manage the loans and have fees associated with management. On Prosper, prospective lenders are able to bid a portion of the requested amount and the interest rate until a package of several lenders totals the full amount requested. These sites are tied to an individual's personal credit and can present some difficulties for individuals to get money in different situations.

Helpful Links and Information Sources

Bank of America Small Business Online Community

Small Business Administration Website

About.com Article on Small Business Financing

StartupNation.com Article on Small Business Funding

Business.com Small Business Finance Page

Business.gov Funding Search Page

Self Help Organization Home Page